We are located on the 6th floor of Triton Towers Three in Renton, WA. We're next to the Renton Village Shopping Center, across the street from Sam's Club and at the intersection of S. Grady Way and Talbot Rd S. Get Directions...

707 S. Grady Way Suite 600

Renton, WA 98057

- Details

- Written by: Super User

- Category: Pages

- Hits: 5527

Our Amazing Projects

Great design comes with understanding our clients needs- Details

- Written by: Super User

- Category: Pages

- Hits: 1755

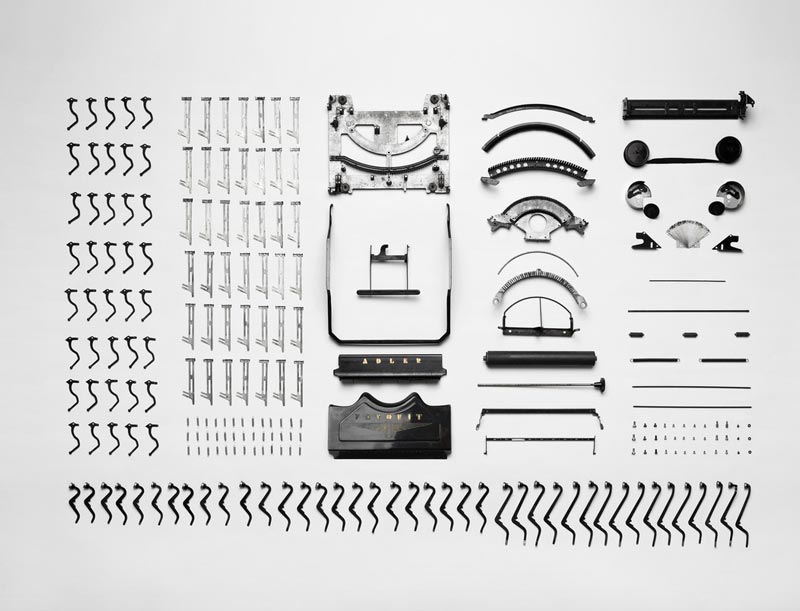

Shape5 Vertex uses articles to display a 404 page rather than a hard coded php file that's hard to modify, like many other designs do. This means you can modify the look or wording of the page very easy without having to modify a file, and it keeps all of your site navigation in tact for ease of use for your site viewers since it uses the template and not an external file. It's as simple as editing an article through the CMS to make any desired changes, or simply leave it as shown! Our site shapers come pre-packaged with the custom 404 page article. If you are setting up a brand new site without a site shaper the easy follow instructions are below the screenshot on this page.

Setup Instructions

- These instructions are for non site shaper installs. If you're installing with a shaper just make sure to leave the article titled "404 Error Page" published and you're done!

- If you are installing a fresh installation with no sample data simply create an article and make sure it's titled "404 Error Page". It must be given this name for the Vertex framework to identify the page needed to be used.

- You can put any content that you want on this new article, or we've provided the code used on this demo below.

- Save the article to any category, just make sure it's published.

- That's it, you're done! The site will now redirect to this article when ever an unrecognized url is detected.

The Code Used For This Demo

<h3 class="title_404">404</h3>

<span class="line_1_404">Oops, sorry we can't find that page!</span>

<br />

<span class="line_2_404">Either something went wrong or the page doesn't exist anymore.</span>

<br />

<a href="" class="readon">Home Page</a>

</div>

- Details

- Written by: Super User

- Category: Pages

- Hits: 1824

Find Our Most Frequent Questions Below

You will have several questions when choosing the right attorney and law firm to represent you in your legal matter. Below is a list of Frequently Asked Questions (FAQs) about our services and business. If your don't find an answer to your question or want a further explanation, please feel free to interact with us on our forum.

Customer Support Questions

Our main office hours are Monday to Friday, 9AM to 5PM.

Our clients are always encouraged to reach out to us via phone, email or contact form. We take pride in our customer service and will respond in a timely manner.

Yes, excluding Immigration & Business cases. All other clients receive a free 15-minute initial consultation. It takes time for us to understand your problem and why you need to legal representation. Before any fees are charged, we want to ensure that we listen to you and we're able to help.

Immigration & Business cases, however, requires more time and effort in order to give you any value to the consultation.

A retainer can be seen as a down payment for us to begin working on your case. The funds are stored in a trust account (managed by WA state) and still belong to you. We take payment from this trust account only after the work is billed and you are invoiced. This gives you maximum protection of the law and keeps your money separate from our operating accounts.

If the case is resolved before all your funds are depleted, we will refund you the remaining amount. If the work required exceeds the retainer amount, we will ask you to replenish the funds.

Tax Related Questions

Both certified public accountants (CPA) and tax attorneys have in depth knowledge of the tax laws and provide tax planning and support. However the topic of “taxes” involves multiple aspects that may pertain to a particular individual or business. There is the accounting aspect, the tax preparation aspect, the tax planning aspect, and the tax defense aspect.

A CPA can choose to defend clients during tax audits or collections, however, many do not choose to. Tax Attorneys are educated to handle legal challenges and can represent a client in the court system, if necessary. Read more ...

Unlike most tax attorneys, CPAs have a lot more knowledge on accounting principles. While tax attorneys are very well versed on tax laws, not all of them choose to do tax preparation. A CPA can help a taxpayer substantiate their deductions and losses, which will help strengthen the taxpayer’s case. A CPA who initially prepared the taxpayers taxes is crucial during the tax audit, as they likely contain the documents used to prepare the taxes. However, later down the road after a tax is already deemed owing, a tax attorney is trained to challenge the assessed liability, penalties, and provide the taxpayer with a collection alternative, such as settlements with the IRS (offers in compromise) or setting up the taxpayer on the ultimate installment repayment plan.

Most tax attorneys like to take a case from the audit stage to end – to the collection stage, as making the wrong arguments during the audit may detrimentally impact the result of the case.

Etiam tempus facilisis ultrices. Nam adipiscing nunc nec est dapibus, eget eleifend velit mattis. Curabitur facilisis a rhoncus sem volutpat in condimentum augue at viverra. Ut ut tortor feugiat, dignissim nulla non, venenatis leo.

Morbi nunc nunc, elementum quis tortor et, feugiat pharetra eros. Mauris mattis purus at lobortis auctor. Nullam eros velit, laoreet vel libero posuere, a rhoncus sem volutpat in eleifend ornare libero. Cras iaculis interdum dui.